Solar Panel GST rate 2023

Whether GST is applicable on the sale of wind and solar energy

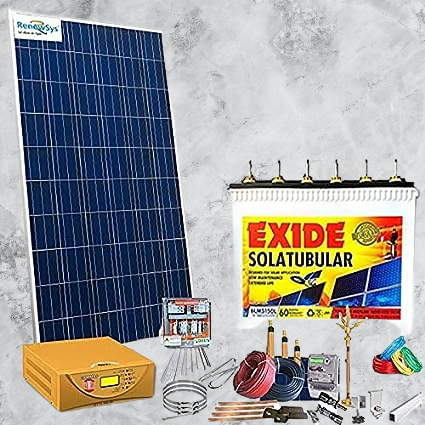

Notification No. 1/2017-Central Tax (Rate) dt. 28.06.2017 ("Goods Rate Notification" for short) sets out the rate for environmentally friendly power gadgets as 5 % (CGST 2.5%; SGST 2.5%). Further, Notification No. 11/2017-Central Tax (Rate) dt. 28.06.2017 ("Services Rate Notification" for short) sets out the GST pace of 18% (CGST 9%, SGST 9%) for administrations via development or designing or establishment or other specialized administrations, gave in connection of setting up of environmentally friendly power gadgets. So it led to the uncertainty about the rate which ought to be material in cases wherein the individual is attempted the total agreement of giving the sustainable power gadgets alongwith the administrations of their establishment and setting up. Indeed, even the development decisions gave in such manner gave unique perspectives. So to welcome the lucidity on this issue, a clarification was embedded in the Goods Rate Notification vide Notification No. 24/2018-Central Tax (Rate) dt. 31.12.2018 w.e.f 01.01.2019. The applicable concentrate of the Goods Rate Notification peruses as under:

Recently Development

Since, the above clarification was viable w.e.f. 01.01.2019, there was no clearness w.r.t. the relevant rates for the period upto 31.12.2019. Again to acquire lucidity this matter GST Council in its 45th gathering satisfied that the for the period before 01.01.2019, GST on the sustainable power projects will be paid on 70:30 instrument just for example the clarification makes a review difference. The applicable concentrate of the minutes of 45th GST Council meeting peruses as under: 8. GST on indicated Renewable Energy Projects can be paid concerning the 70:30 proportion for labor and products, separately, during the period from 1.7.2017 to 31.12.2018, in similar way as has been endorsed for the period on or after first January 2019.

Further, vide Notification No. 8/2021-Central Tax (Rate) dt. 30.09.2021, the Goods rate Notification has been corrected and the rate on sustainable power gadgets has been expanded to 12% (CGST 6% and SGST 6%) from 5% w.e.f. 01.10.2021. In this manner, presently the viable rate on environmentally friendly power undertakings would be 13.8% [(12%*70%) + (18%*30%)]

~2.jpg)

%20(31).jpg)

Comments

Post a Comment